Don’t Panic! Here’s How to Reverse that UPI Transaction money transferred wrong UPI account,Fraudulent Activity, or in stuck on Pending status in apps like PhonePe, BHIM, or Google Pay.

Sending money through UPI is convenient, but mistakes happen. Whether you enter the wrong phone number, fall victim to a scam, or simply encounter a technical glitch, this guide equips you with the knowledge to handle various situations and you can get your money back..

So, here’s what you can do if you’ve sent money to the wrong account or encountered fraudulent activity:

- Contact Your Bank: Get in touch with your bank immediately with the transaction ID, report the wrong transaction or fraudulent activity, and request a refund.

- File a Complaint on the NPCI Portal: Here’s how you can lodge your complaint on NPCI:

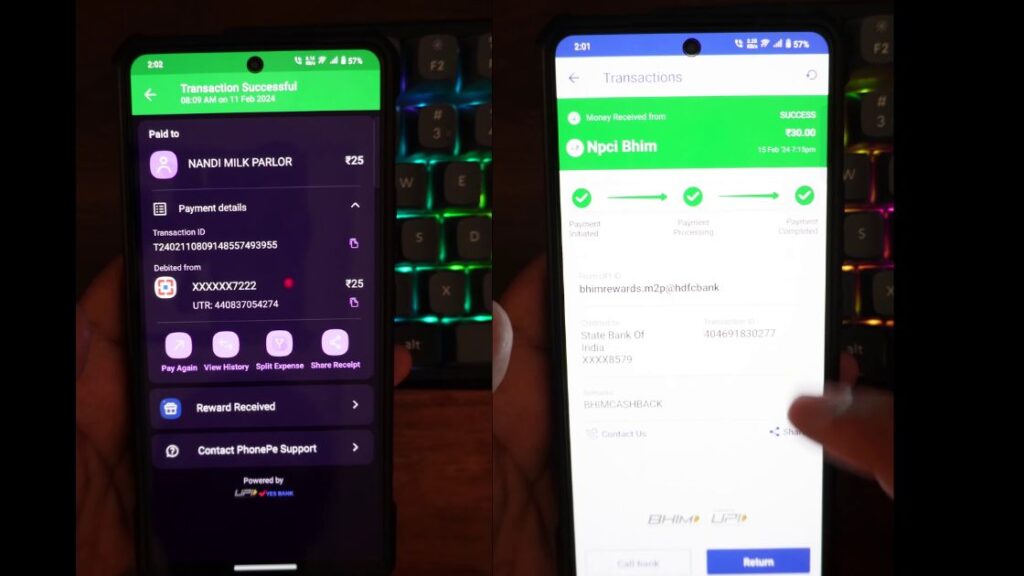

- Select ‘Transaction’ in the complaint form.

- Choose the nature of the transaction type related to person-to-person transactions and merchant transactions.

- Fill in your details, including the issue, Transaction ID (in Phonepe: UTR NUMBER), Bank name, Amount, Your UPI ID, Transaction date, Email ID, and Mobile number.

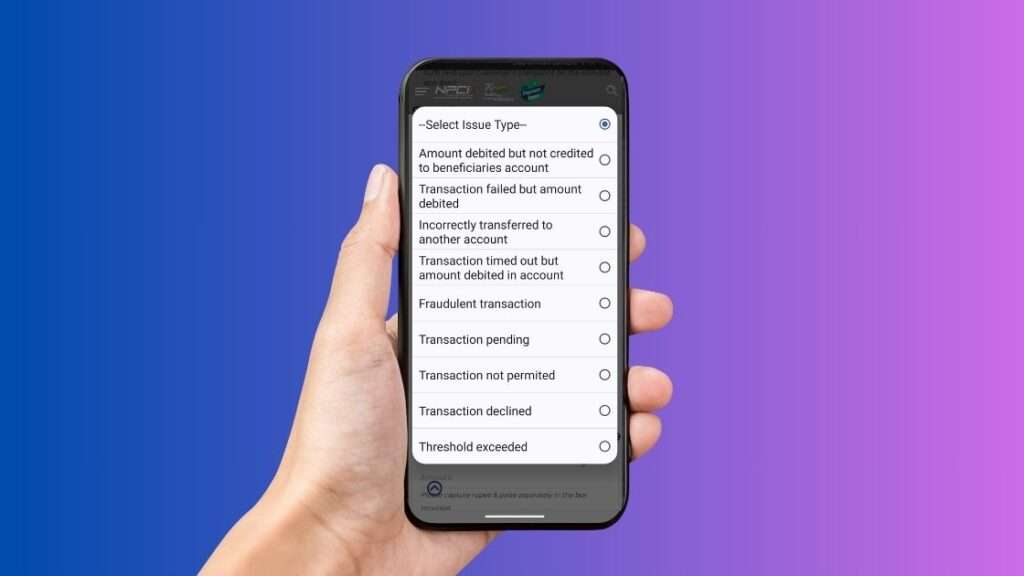

- Select the appropriate issue from the list, such as:

1.Money debited but not credited to the beneficiary’s account.

2.Money was debited but the transaction failed.

3.Incorrect transfer (money sent to the wrong UPI ID).

4.Transaction timed-out but money debited.

5.Fraudulent transaction.

6.Transaction pending.

7.Declined transaction.

3.Upload a screenshot of the bank account statement showing the transaction.

4. Click the submit button, and the complaint should be resolved.

5.After submitting, wait 7-14 days. If the transaction is not reversed within this time, you can contact the Banking Ombudsman of RBI.

Thanks for this information 🤠

i got money back, thank you bhaiya🤠